Fund Information

When you joined your employer plan, you chose to invest in one of five multi-asset-class funds, or the SIL Employer Scheme Cash Fund (a single-asset-class fund). Your employer’s contributions will usually be invested in the same fund, or funds, you have chosen unless specified in the Supplement.

Here’s an overview of the funds:

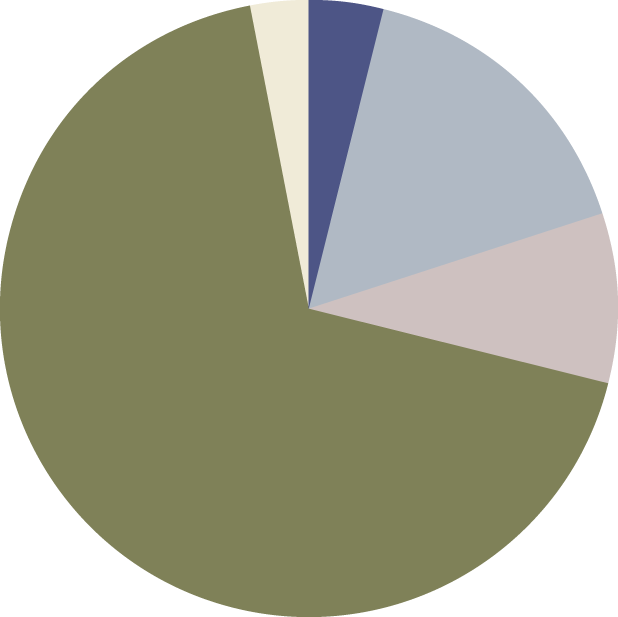

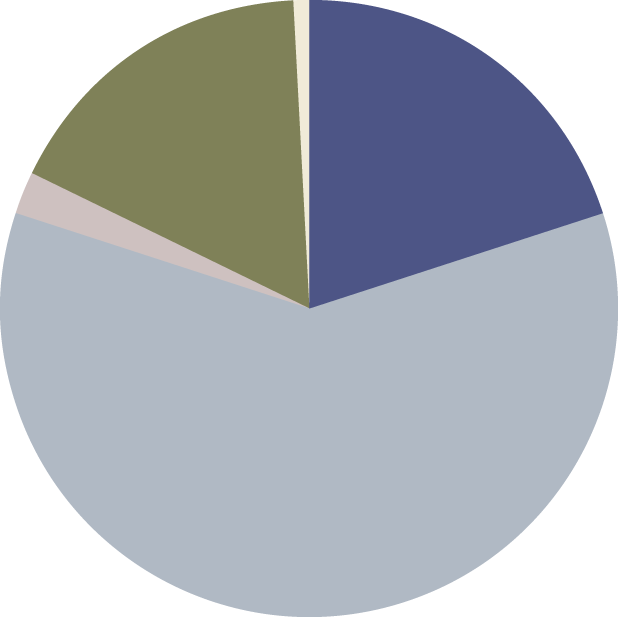

SIL Employer Growth Fund

The SIL Employer Growth Fund invests mainly in growth assets (equities, listed property and listed infrastructure), with a smaller exposure to income assets (cash and cash equivalents and fixed interest). The fund may also invest in alternative assets.

Target investment mix summary

*4% Cash and cash equivalents

*16% New Zealand and international fixed interest

*9% Listed property

*68% Australasian and international equities

*3% Other (listed infrastructure)

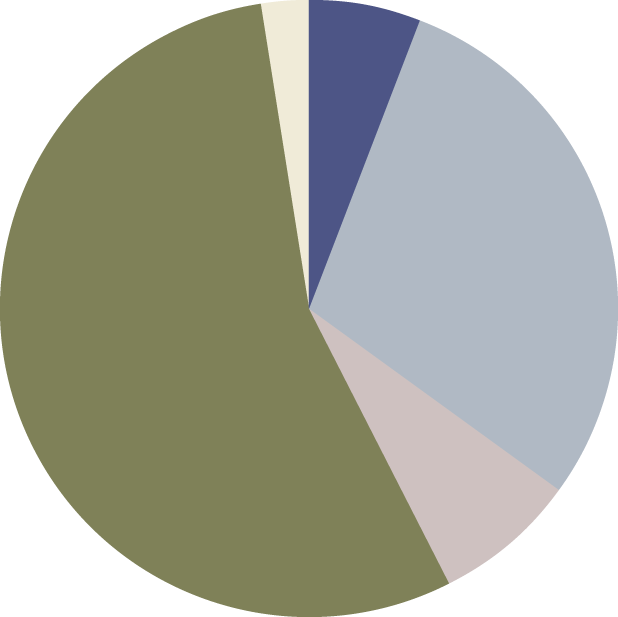

SIL Employer Balanced Growth Fund

The SIL Employer Balanced Growth Fund invests mainly in growth assets (equities, listed property and listed infrastructure), with some exposure to income assets (cash and cash equivalents and fixed interest). The fund may also invest in alternative assets.

Target investment mix summary

*6% Cash and cash equivalents

*29% New Zealand and international fixed interest

*7.5% Listed property

*55% Australasian and international equities

*2.5% Other (listed infrastructure)

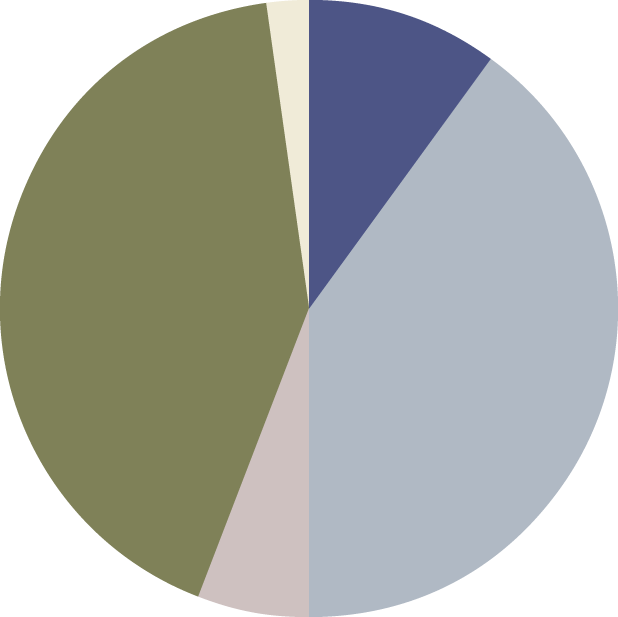

SIL Employer Balanced Fund

The SIL Employer Balanced Fund invests in similar amounts of income assets (cash and cash equivalents and fixed interest) and growth assets (equities, listed property and listed infrastructure). The fund may also invest in alternative assets.

Target investment mix summary

*10% Cash and cash equivalents

*40% New Zealand and international fixed interest

*6% Listed property

*42% Australasian and international equities

*2% Other (listed infrastructure)

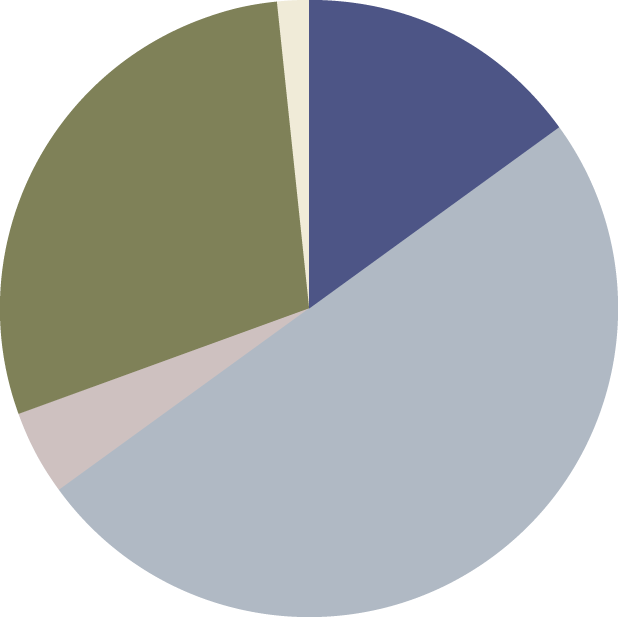

SIL Employer Conservative Balanced Fund

The SIL Employer Conservative Balanced Fund invests mainly in income assets (cash and cash equivalents and fixed interest), with some exposure to growth assets (equities, listed property and listed infrastructure). The fund may also invest in alternative assets.

Target investment mix summary

*15% Cash and cash equivalents

*50% New Zealand and international fixed interest

*4.5% Listed property

*29% Australasian and international equities

*1.5% Other (listed infrastructure)

SIL Employer Conservative Fund

The SIL Employer Conservative Fund invests mainly in income assets (cash and cash equivalents and fixed interest), with a smaller exposure to growth assets (equities, listed property and listed infrastructure). The fund may also invest in alternative assets.

Target investment mix summary

*20% Cash and cash equivalents

*60% New Zealand and international fixed interest

*2.25% Listed property

*17% Australasian and international equities

*0.75% Other (listed infrastructure)

SIL Employer Cash Fund

The SIL Employer Cash Fund invests mainly in cash and cash equivalents. Investments may include cash and cash equivalents issued by New Zealand-registered banks, the New Zealand Government, corporations or local authorities, or non-New Zealand governments.

Target investment mix summary

*Cash and cash equivalents

More details on how the funds invest can be found in the statement of investment policy and objectives, which is available on the scheme register at companiesoffice.govt.nz/disclose (click on ‘Search schemes’ and search SIL Mutual Scheme).

If you’re a member of the SIL Employer Scheme through the ING Superannuation Plan, click here for your fund options.