Update your tax rate

SIL is a portfolio investment entity (PIE). This means the taxable income is shared by members based on the number of units a member holds. Your prescribed investor rate (PIR) is used to calculate the amount of tax payable on your behalf.

Taxes that apply to your investment account are paid by cancelling units in your investment account equal to the value of tax liability you need to pay.

In certain circumstances, SIL may receive tax refunds. When this happens, units will be added to your account equal to the value of your share of the tax refund.

It’s up to you to make sure your PIR is correct. Providing a PIR that is too low means you will be required to pay any tax shortfall as part of the income tax year-end process. Providing a PIR that is too high means you any tax over-withheld will be used to reduce any income tax liability you may have for the tax year and any remaining amount will be refunded to you.

If you need to update your PIR, you can do it online by logging into ANZ Internet Banking or by calling 0800 736 034.

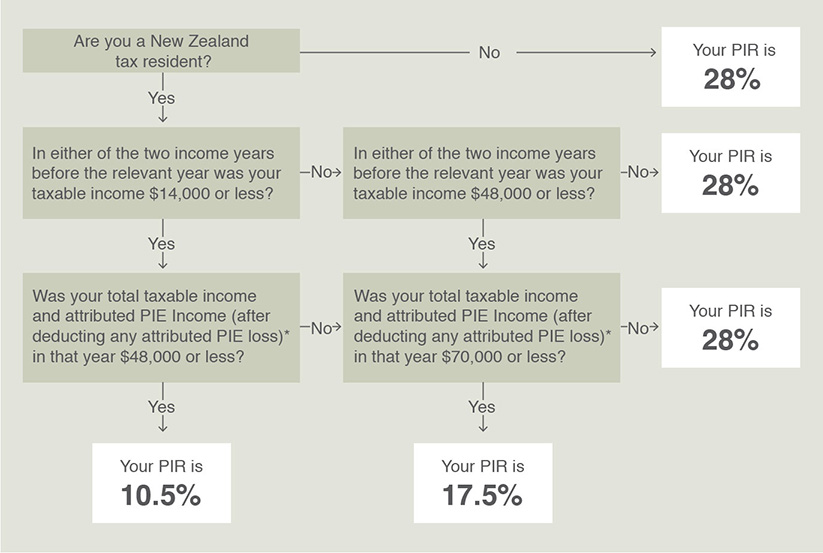

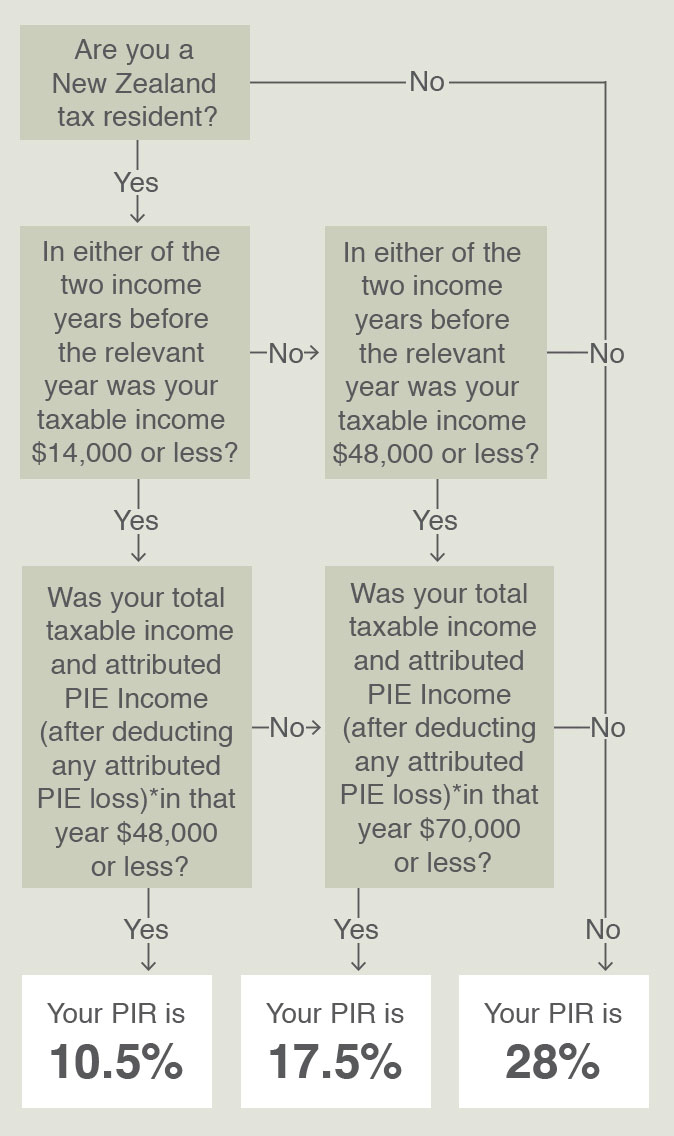

Use the following diagram to work out your PIR. Inland Revenue can require us to use a different PIR if they consider you’ve given an incorrect PIR.

If you have considered the two previous income years and determine that you qualify for two different rates, your PIR is the lower rate.

Your worldwide income must generally be included in ‘taxable income’ when determining your PIR, even if you were not resident in New Zealand when that income was earned. Exceptions apply. For more information, see ird.govt.nz or consult a tax adviser.

*Your attributed PIE income or loss for an income year is the amount of income or loss attributed to you by PIEs (including SIL) in that income year, as recorded in the tax certificates issued by PIEs to you at the end of each income year. An income year generally runs from 1 April of the previous year to 31 March of the current year.